The Timeline highlights significant developments in the history of financial regulation against U.S. and world events. Choose a decade to start, scroll down to read more. Learn more about building the Timeline.

The Arizona Securities Act was passed two years after its State Securities Commission, headed by future SEC Commissioner Earl Hastings, was founded. The Act was in response to the 1940s mining frauds perpetrated by Constantino Riccardi, and among the first state laws to explicitly coordinate with the U.S. Securities and Exchange Commission on enforcement and exemptions.

Louis Loss, SEC Associate General Counsel, published the first academic treatise on the regulation of securities while teaching part-time at Yale Law School.

In SEC v. Ralston Purina, the U.S. Supreme Court laid down the critical tests for the availability of the “private offering” exemption under what is now Section 4(2) of the Securities Act of 1933.

The U.S. Supreme Court’s decision in Wilko v. Swan established that a pre-dispute agreement to arbitrate claims under the Securities Act of 1933 was unenforceable. The ruling stood until 1989.

The Committee on Accounting Procedure of the American Institute of Accountants codified all its pronouncements on generally accepted accounting principles in Accounting Research Bulletin 43.

The U.S. Securities and Exchange Commission amended proxy rules to restrict the type of shareholder proposals that were required to be included in company proxy statements. Some argued that this curtailed shareholder democracy.

The New York Stock Exchange's "Own Your Share of American Business" campaign launched efforts by major stock exchanges to attract a broadened shareholding public. Promising greater power over corporate behavior to investors, exchanges added to their listing standards quorums for shareholder meetings and mandatory independent directors.

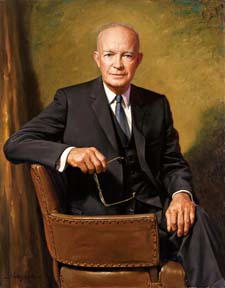

During the decade, a number of staff positions at the U.S. Securities and Exchange Commission were eliminated due to budget cuts; by 1955, the SEC had just under 700 employees. Due to the staff shortage, the SEC regional offices were directed to rely on state authorities to investigate and prosecute securities cases.

TIME published “Protection for Investors: The SEC is Unequal to the Job,” criticizing the U.S. Securities and Exchange Commission for being dominated by the financial industry. The SEC was faulted for choosing to prosecute small brokerage firms, rather than major Wall Street firms.

The Uniform Securities Act was adopted either in whole or in part in 37 states. It attempted to balance the need to protect investors from fraud with the need of states and businesses to raise capital efficiently. One innovation was a provision for “registration by coordination,” which allowed securities already registered under the federal securities laws to be exempt from further registration requirements, unless they were subject to a stop order by federal regulators.

The New York Stock Exchange established Rule 394, forbidding its members from making transactions in NYSE stocks off the exchange.

In Accounting Research Bulletin 48, the AICPA Committee on Accounting Procedure allowed for pooling-of-interests accounting for business combinations in the presence of certain attendant circumstances. The criteria were often ignored or weakly enforced by the U.S. Securities and Exchange Commission.

Utility companies sought to enjoin the AICPA Committee on Accounting Procedure from issuing a requirement that deferred taxes be included among liabilities, at variance with industry practice of including them in equity. After the U.S. Supreme Court denied certiorari, the committee clarified that deferred taxes should be shown as a liability or deferred credit. The U.S. Securities and Exchange Commission confirmed this requirement in Accounting Standards Release No. 85.

Congress adopted a general Code of Ethics for officials and employees of the federal government. Two decades later, in 1978, the Ethics in Government Act mandated annual public financial disclosure by all senior federal personnel, and established the Office of Government Ethics.

In 1957, the U.S. Securities and Exchange Commission had brought Crowell-Collier, an administrative action against American Stock Exchange members, but failed to uncover the breadth of fraudulent activity in which AMEX members engaged. In 1959, the U.S. House of Representatives Special Subcommittee on Legislative Oversight issued a report criticizing the SEC for its delay in investigating investor complaints and imposing minimal penalties in the AMEX case.

Facing criticism for failing to reduce the number of acceptable accounting alternatives, the AICPA replaced the Committee on Accounting Procedure (CAP) with the Accounting Principles Board (APB). The APB was intended to develop conceptual context from which would flow specific applications, then choose between alternate rules and procedures to narrow differences. The APB soon turned from conceptual context to solving specific problems, as had the former CAP.