The Timeline highlights significant developments in the history of financial regulation against U.S. and world events. Choose a decade to start, scroll down to read more. Learn more about building the Timeline.

The SEC adopted new rules to strengthen auditor independence after Congress and the audit profession rebuffed stricter rules originally proposed by SEC Chairman Arthur Levitt Jr.

Regulation FD prohibited a company from intentionally disclosing information to select persons, such as securities firms and institutional investors, without disclosing that information to the public at large.

Online trading grew as retail investors were able to trade from personal computers and were attracted by discount brokerage rates. Online trading also gave rise to day trading. Day traders usually worked from their homes or firms that specialized in day trading, buying equity securities and holding them for very short periods of time, sometimes only minutes, in an attempt to take advantage of price discrepancies or momentary price volatility.

Initial public offerings (IPOs) increased during the late 1990s, spurred by dot-coms, with many Internet-related IPOs trading on Nasdaq. It was not unusual for dot-com companies, with little earnings history, to have their IPO prices soar after trading began. The dot-com IPO bubble burst on March 10.

The New York Stock Exchange’s use of decimal price increments, rather than fractions, to make bids and offers caused spreads to narrow, thereby reducing trading costs for small investors.

The Commodity Futures Modernization Act clarified regulatory responsibility between the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission for futures trading, repealing a ban on trading single stock futures.

The S&P Global 100 Index, launched February 7, was the first equity stock index covering global companies.

The North American Securities Administrators Association introduced the Investment Adviser Representative (IAR) Competency Exam to establish and enforce threshold requirements for an investment adviser’s knowledge of economics, investment vehicles, investment strategies and ethics. The Investment Adviser Registration Depository (IARD) streamlined registration, allowing any adviser not solely regulated under state law to register with the U.S. Securities and Exchange Commission and share its registration information and ongoing amendments with the state regulators requiring such information through “notice filings.” The IARD also provided investors with a searchable database of investment advisers and firms’ employment and disciplinary histories.

Nasdaq became a private company, independent of the NASD, providing increased flexibility required to compete in securities markets. Its sources of capital expanded beyond order flow to include listing fees, regulatory fees, and market data.

With encouragement from the Municipal Securities Rulemaking Board, municipal bond market participants formed the Muni Council to address industry problems, especially in improving secondary market disclosure.

The odd-eighths scandal having demonstrated that fractional quoting tended to keep broker-dealer fees artificially high, after an interval of quoting in sixteenths, all securities markets began quoting in decimals.

On September 11, as the World Trade Center towers fell, the impact on the securities industry was major. Excluding emergency workers and airline passengers, over 70% of persons killed that day in New York City worked in the financial services industry. The Seven World Trade Center building, which housed the SEC New York Regional Office, later collapsed with no fatalities. Most of the Wall Street area had no utilities or communication services and was covered in debris. Several billion dollars of physical securities were destroyed.

Federal, state and local governments, the U.S. Securities and Exchange Commission, self-regulatory organizations and the private securities industry worked closely with each another to allow the debt markets to re-open on September 13 and the equity and option markets on September 17. The SEC used its emergency powers to allow issuers to buy back their own stock at the open and close of the market, so that they could temporarily stabilize the market. A variety of net capital, settlement and recordkeeping rules were waived, amended or suspended, as were prohibitions regarding borrowing from affiliates.

Enron was a provider of natural gas, electricity and telecommunications. By early 2001, its assets grew to $65 billion. However, in November, Enron announced that it would restate its earnings from 1997 to 2000 because of accounting errors. The restatements were the result of moving assets off Enron’s balance sheet into a variety of partnerships, in part owned by Enron executives. Such illegal off-balance sheet financing allowed Enron to conceal losses by creating the appearance that transactions were hedged, when in fact the counterparty was an Enron-related entity. Some of the executives in these partnerships then reaped millions of dollars from them. A variety of checks and balances within the company failed, including oversight by the board of directors, by Arthur Andersen, its accounting firm, and by its in-house and outside attorneys.

Archipelago Electronic Communications Network and the Pacific Exchange merged to create ArcaEx, the first totally electronic stock exchange.

The Financial Accounting Standards Board revised the rules for accounting for business combinations, requiring that all acquisitions be accounted for by the purchase method, thus ending the controversial pooling-of-interests method. The FASB amended the rules for goodwill and other intangible assets, indicating that goodwill and intangibles with indefinite lives would not be amortized but tested at least annually for impairment.

In 1998, WorldCom and MCI Communications completed a $37 billion merger. Starting in mid-1999, and continuing at an accelerated pace into 2002, the company masked declining earnings by painting a false picture of growth and profitability. After the fraud was discovered, the company filed for bankruptcy protection. The U.S. Securities and Exchange Commission implemented an one-time requirement for certifications by chief executives and financial officers of major companies of their filings; the requirement was perpetuated in the Sarbanes-Oxley Act.

Arthur Andersen LLP, one of the Big Five accounting firms, was convicted of obstruction of justice for shredding documents relating to the Enron audit, and the 89-year-old audit firm surrendered its licenses to practice public accounting in the U.S. and closed its doors. Founded in 1913 by accounting professor Arthur Andersen, the firm once known for its auditing integrity and technical precision was alleged to have been involved in fraudulent accounting and auditing of Sunbeam Products, Waste Management, Enron, and WorldCom among others. In 2005, the U.S. Supreme Court unanimously reversed the company’s conviction, but the firm was already defunct.

Congress enacted the Sarbanes-Oxley Act (SOX) on July 30, in light of the Enron, WorldCom, Global Crossing, Adelphia and Tyco corporate scandals. SOX prohibited an accounting firm from providing audit work for a public company while contemporaneously providing a host of other services. SOX required each public firm to have an audit committee composed of independent directors, and prohibited company loans to certain executives and directors. It required attorneys for public corporations to report material violations of law to the corporation’s chief legal advisor and/or the CEO. One of the most controversial aspects of SOX was Section 404, requiring management certification of internal controls over financial reporting. These measures increased the federal government's oversight regarding corporate compliance standards.

SOX also provided that the Financial Accounting Standards Board would be financed by fees against public companies; the FASB previously had received voluntary funding through product sales and membership contributions.

One of the provisions of the Sarbanes-Oxley Act was the creation of the Public Company Accounting Oversight Board (PCAOB). The PCAOB was authorized to establish a registration process for public accountants, create audit standards, engage in inspections of public accountants and conduct disciplinary hearings. In 2010, the U.S. Supreme Court upheld the creation of the PCAOB, as well as the method of appointing its board members. It agreed with plaintiffs that the requirement that the U.S. Securities and Exchange Commission show good cause for removing board members was unconstitutional, and that board members served at the will of the SEC.

Under the authority of the Martin Act, New York State Attorney General Eliot Spitzer launched an investigation of Internet stock research analysts at Merrill Lynch, discovering that research analysts had manipulated research and produced misleading ratings. A $100 million settlement spurred a multi-state investigation of research analysts that implicated other major Wall Street firms using their research analysts to hype technology and dot-com stocks with an eye towards securing lucrative business in initial public offerings (IPOs) for their investment banking divisions.

A new Uniform Securities Act sought to replace the largely-disused 1985 Revised Uniform Securities Act with an updated, market-responsive and enforcement-ready model of state securities law. It simplified blue sky filings and registrations, placing the the Act in accord with the federal National Securities Markets Improvement Act.

The Financial Accounting Standards Board and the International Accounting Standards Board began working together towards the international convergence of accounting standards, describing convergence and the tactics to achieve it in the 2002 Norwalk Agreement, followed by a 2006 Memorandum of Understanding issued between the boards. In 2007, the U.S. Securities and Exchange Commission began accepting financial statements from foreign private issuers prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the IASB without reconciliation with U.S. generally accepted accounting principles.

The New York Stock Exchange received approval from the U.S. Securities and Exchange Commission for new corporate governance standards for listed companies, requiring boards to have a majority of independent directors, and requiring nomination, compensation and audit committees to consist solely of independent directors.

Following a mandate in the Sarbanes-Oxley Act, the U.S. Securities and Exchange Commission created rules for the conduct of attorneys practicing before it. The American Bar Association amended its Model Rules of Professional Conduct to accommodate the SEC’s rules.

State and national securities regulators undertook a coordinated effort to investigate research analyst misconduct at major Wall Street firms, following New York State’s settlement with Merrill Lynch. The $1.4 billion global settlement with ten firms required each firm to set up “Chinese walls” separating its analysts from its investment bankers.

The U.S. Securities and Exchange Commission reaffirmed its recognition of Financial Accounting Standards Board pronouncements as generally accepted accounting principles, satisfied that the FASB met the standard-setter criteria of Section 108 of the Sarbanes-Oxley Act.

New York State Attorney General Eliot Spitzer charged a small number of mutual funds with allowing customers to purchase shares at the previous day's net asset value and to trade frequently against a rising and falling market. The U.S. Securities and Exchange Commission and several state securities commissions then brought action against a number of fund families.

The PCAOB adopted and the SEC approved Auditing Standard No. 2 to enact Section 404 of the Sarbanes-Oxley Act of 2002 requiring that management report on the effectiveness of internal control over financial reporting and auditors attest to that assessment. Public companies, facing a backlog of deferred maintenance, felt burdened by increased cost and time required to comply, and audit firms did substantially more work to comply with the new PCAOB standard. Critics complained of onerous and anticompetitive regulation while supporters pointed to numerous benefits including a reduced cost of capital. After more than three years, the PCAOB replaced AS 2 with Auditing Standard No. 5 a streamlined, more risk- and principles-based approach that retained the core principles of the original standard.

The Senate Banking Committee conducted a hearing to review the status of municipal securities regulation, with particular emphasis on Municipal Securities Rulemaking Board price transparency initiatives, and the increasing use in municipal financings of interest rate swaps and other similarly unregulated derivatives.

The Office of the Comptroller of the Currency preempted state anti-predatory lending laws that had provided protection for consumers from risky mortgage products.

The U.S. Securities and Exchange Commission granted an exemption of the net capitalization rule, mandating a twelve-to-one leverage limit, to the five largest investment houses: Bear, Stearns & Co., Goldman Sachs, Lehman Brothers, Inc., Merrill Lynch and Morgan Stanley.

The Central Post Office brought together information from the various Nationally Recognized Municipal Securities Information Repositories (NRMSIRs) to make disclosure more efficient.

The U.S. Securities and Exchange Commission adopted rules to ease compliance with the regulatory framework of the ’33 Act. Among its innovations were rules addressing Web cast, audio cast and Internet delivery of prospectuses, and rules permitting certain large issuers to communicate about their securities at any time.

The Energy Policy Act of 2005 repealed the Public Utility Holding Company Act of 1935, giving jurisdiction over public utility holding companies to the Federal Energy Regulatory Commission.

Regulation NMS established rules to modernize and strengthen the regulatory structure of national equity markets, and re-designated rules previously adopted by the U.S. Securities and Exchange Commission to facilitate the creation of a national market system. The Order Protection Rule required market participants to honor the best prices displayed in the national market system by automated trading centers, thus establishing a critical linkage framework; the Access Rule limited fees; the Sub-Penny Rule set minimum price increments; and the Market Data Rule provides for improved investor information.

After nine years of experience with Rule G-38, noting increases in the use and compensation of consultants, as well as increases in the political contributions made by consultants, the Municipal Securities Rulemaking Board banned municipal securities dealers from using consultants to solicit business.

The Municipal Securities Rulemaking Board required dealers to submit all transaction information within fifteen minutes of execution, to ensure price transparency in the municipal securities market and to conform with other major securities markets.

In order to regain the competitive advantage lost to the rise of ECNs, Nasdaq held an initial public offering and purchased Instinet shortly thereafter.

The Credit Rating Agency Reform Act created a registration scheme, to be administered by the U.S. Securities and Exchange Commission, for credit rating agencies to be treated as nationally recognized statistical ratings organizations. Its purposes were to increase competition and transparency, and to minimize conflicts of interest.

A year after its specialists were converted into market makers, the New York Stock Exchange became a public company and shortly thereafter acquired Archipelago ECN, enabling the new NYSE Group, Inc. to better compete in the wake of Regulation NMS.

College savings plans established by state issuers under Section 529 of the Internal Revenue Code used registered mutual funds as primary investment vehicles, and were not regulated as mutual funds under federal securities laws. The Municipal Securities Rulemaking Board and the NASD determined that 529 plan sales and mutual fund sales presented the same broker-dealer practice issues, and issued a joint statement indicating that they would attempt to conform future rules and interpretations on sales practices.

The Second Circuit Court of Appeals ruled that the Securities Litigation Uniform Standards Act (SLUSA)’s preemption of state securities laws was limited to class actions involving fraud in inducing investors to sell or purchase stock, but not to cases involving fraud in encouraging investors to hold such stock, since this type of case could not be brought under federal law. The U.S. Supreme Court held that the SLUSA did preempt state-law-based class actions for fraud, even when the fraud caused investors to hold a security, rather than to buy or sell. The Court noted that individuals and groups of private plaintiffs of less than 50 could still bring suits alleging fraud under state securities laws.

The Financial Accounting Standards Board accelerated a move from cost-based measurements to fair value measurements by adopting uniform definitions of fair value and guidance for applying those definitions. A year later, the FASB allowed entities to choose to measure many financial instruments at fair value.

After service as a SEC Commissioner and as Chair of the Commodity Futures Trading Commission, Mary Schapiro became president of NASD Regulation, Inc. in 1996. In 2006, she became NASD's Chair and CEO, overseeing NASD's consolidation with the member regulation, enforcement and arbitration functions of the New York Stock Exchange to form FINRA.

The U.S. Securities and Exchange Commission rule on access equals delivery mandated the posting of electronic documentation in disclosure, paving the way for the creation of all-electronic disclosure for the municipal securities market.

The National Association of Securities Dealers and the member regulation, enforcement and arbitration functions of the New York Stock Exchange merged to form FINRA (Financial Industry Regulatory Authority), the largest non-governmental regulator for securities firms doing business in the United States.

NYSE Group, Inc. and Euronext, N.V. merged, bringing together major securities markets across the United States and Europe.

The securitization of mortgages on loans to poor credit risks and the creation of related credit default swaps created a situation in which highly leveraged major investors and investment houses found themselves in possession of portfolios rapidly declining in value.

The U.S. Supreme Court rejected the “scheme liability” theory in Stoneridge Investment Partners, LLC v. Scientific America, Inc.. The theory posited that those allegedly participating in a deceptive scheme, but not communicating with the public, could be charged as primary violators of the federal securities laws.

In March, the Federal Reserve extended its role as an emergency lender, intervening to facilitate the purchase of investment house Bear, Stearns & Co. by JPMorgan Chase. The Fed also took the unprecedented step of temporarily opening its discount window to make secured loans to primary dealers. The move was designed to improve the ability of dealers to extend credit to participants in the faltering securitization markets.

Secretary of the Treasury Henry Paulson released a “blueprint” proposal to Congress to revise the financial regulatory system, giving more authority to the Federal Reserve, and combining the functions of many regulatory agencies, including the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission.

The Municipal Securities Rulemaking Board debuted EMMA (Electronic Municipal Market Access) as a comprehensive centralized online database, specifically tailored for retail, non-professional investors. EMMA became permanent in 2009.

Beginning in September, a worldwide financial crisis led the U.S. government to take emergency actions to bail out or nationalize financial institutions exposed to distressed assets. Fannie Mae and Freddie Mac were taken over by the federal government. Lehman Brothers, Inc. filed for Chapter 11 bankruptcy, Merrill Lynch was sold to Bank of America, and Goldman Sachs and Morgan Stanley were transformed into bank holding companies. Washington Mutual Bank collapsed, the largest bank failure to date in U.S. history. Congress approved the Troubled Assets Relief Program (TARP), a bailout package which would allow the Treasury to buy underperforming mortgage-related securities. However, the U.S. rescue plan failed to slow a global market meltdown. Extreme volatility affected stock markets worldwide, with most suffering record declines. The U.S. unemployment rate rose to over 10% by October 2009, and remained at 9% or higher until the end of 2011. In 2012, government data revealed that the median net worth of American families plunged almost 40% from 2007 to 2010.

In December, Bernard Madoff confessed to running the largest to date Ponzi scheme in U.S. history. Federal regulators were criticized for not detecting the Madoff fraud. Madoff was sentenced to 150 years in prison, the maximum allowed under federal guidelines. Only a fraction of the funds taken from his investors was recovered.

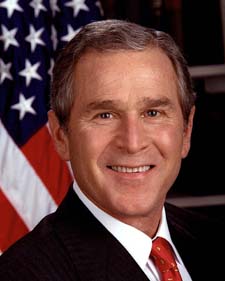

President Obama appointed Mary Schapiro, FINRA’s Chief Executive Officer and a former SEC Commissioner, as the first woman Chairman of the U.S. Securities and Exchange Commission. Among her initial actions was to grant new powers to the Division of Enforcement to allow for faster and more effective investigations, answering concerns about the SEC’s ability to pursue prominent cases linked to the financial crisis. The SEC turned to state regulators to assist on active probes and the training of investigators.

Congress approved restrictions on credit card companies, banning extra fees and fluctuating rates, and providing consumers with more information on their debts.

The Financial Accounting Standards Board launched the FASB Accounting Standards Codification as the single source of authoritative non-governmental U.S. generally accepted accounting principles. Various other announcements from the AICPA and the Emerging Issues Task Force were included in the codification.